The Chrome Crown: Why Tech Giants Are Fighting for Google's Browser

The Battle for Chrome: Tech Giants Race to Acquire Google's Browser Amid Antitrust Fallout

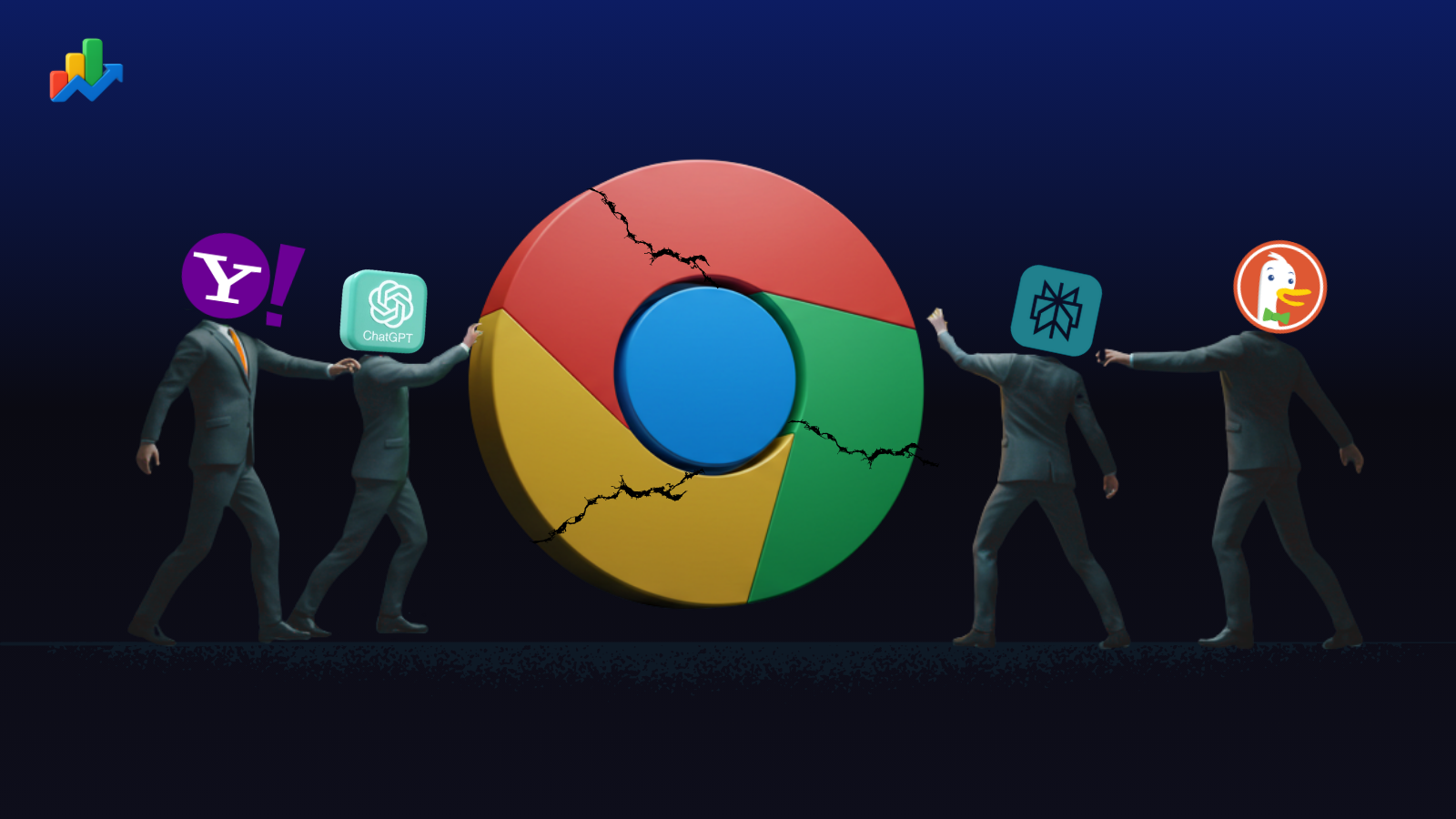

In a dramatic turn of events that could reshape the internet landscape, several major tech companies are positioning themselves to acquire Google Chrome if antitrust regulators force Google to divest its popular web browser. This potential sale, which could be valued at tens of billions of dollars, has attracted interest from unlikely contenders including OpenAI, Yahoo, Perplexity, and to a lesser extent, DuckDuckGo. As the remedies trial in the U.S. Department of Justice's antitrust case against Google continues, the tech world is watching closely to see who might gain control of Chrome's massive 65% market share and 3.3 billion users worldwide.

Why Chrome Is the Ultimate Prize

Chrome isn't just a browser; it's the gateway to the internet for billions of users globally. Controlling Chrome means controlling the default search engine, the new tab experience, and access to vast amounts of user data. This makes it an invaluable asset for any company looking to challenge Google's dominance in search and advertising.

The browser commands approximately two-thirds of the global market share, dwarfing competitors like Apple's Safari (18%) and Microsoft's Edge (5%). This dominance translates to around 60% of search queries coming through web browsers, often directly from the address bar. For companies struggling to gain visibility in a Google-dominated internet, acquiring Chrome represents an instant path to billions of users.

Moreover, Chrome is built on the open-source Chromium platform, which underpins not only Chrome but also other browsers like Microsoft Edge, Mozilla Firefox, and Opera. This makes Chrome even more strategically valuable as a foundational piece of web infrastructure.

The Contenders

OpenAI: Integrating AI into the Browser Experience

OpenAI, the creator of ChatGPT, has emerged as a serious contender in the race to acquire Chrome. Nick Turley, OpenAI's head of product, testified during the trial that the company would be interested in purchasing Google's browser.

For OpenAI, acquiring Chrome would solve a critical limitaion: ChatGPT doesn't have its own search engine and lack access to real-time search data. While ChatGPT excels at generating conversational responses based on its training data, it needs fresh, live information to truly compete with Google. Owning Chrome would give OpenAI a direct channel to billions of users and the ability to integrate its AI capabilities directly into browsing experience.

With Chrome in its arsenal, OpenAI could potentially set ChatGPT as the default search and AI assistant, creating a seamless AI-powered browsing experience that could challenge Google's search dominance. This would represent a significant strategic win for OpenAI in its competition with Google's Gemini AI.

Yahoo: The Comeback Kid

In a surprising development, Yahoo has emerged as an eager bidder for Chrome. Brian Provost, Yahoo Search's General Manager, testified that Yahoo would bid for the Chrome browser if a federal court orders Google to divest it.

"Chrome is arguably the most important strategic player on the web. We would be able to pursue it with Apollo [Global Management Inc.]," Provost stated during his testimony4. He estimated that Chrome could be valued in the tens of billions of dollars but indicated that Yahoo's parent company, Apollo Global Management, would help secure the necessary funds.

For Yahoo, once a dominant search engine in the early 2000s before being overtaken by Google, acquiring Chrome represents a path to revival. The company has been actively working to "revitalize" its search engine since being acquired by Apollo from Verizon Communications in 2021. Yahoo is currently developing a prototype for its own web browser, but Provost acknowledged that acquiring Chrome would be a much faster route to scale.

Provost believes that if Yahoo were to acquire Chrome, the company's search market share could increase from the current 3% to double digits. This would mark a significant comeback for a company that once led the internet search market.

Perplexity: The AI Search Challenger

Perplexity, a rising star in AI-driven search, has also expressed interest in acquiring Chrome. The company's chief business officer testified about their interest during the trial, likely seeing Chrome as a vehicle to rapidly expand their user basee.

Like OpenAI, Perplexity specializes in AI-powered search and is developing its own browser. Their CEO believes this browser will enhance the capabilities of their agents and improve data collection outside their application to "better understand" user preferences, potentially leading to more tailored advertising.

For Perplexity, acquiring Chrome would provide immediate access to billions of users, accelerating their growth and positioning them as a serious competitor in both the browser and AI search markets.

DuckDuckGo: The Unlikely Contender

DuckDuckGo, the privacy-focused search engine, was also subpoenaed during the trial. However, unlike the other contenders, DuckDuckGo has acknowledged that it lacks the financial resources to acquire Chrome.

Gabriel Weinberg, DuckDuckGo's CEO, testified that Chrome might be valued at up to $50 billion based on a rough estimate provided to Bloomberg. This price tag puts Chrome well beyond DuckDuckGo's reach, despite the company's interest in promoting its privacy-centric alternative to Google's ecosystem.

Google's Defense and the Road Ahead

Google strongly opposes any forced divestiture of Chrome, warning that such a move could have far-reaching negative consequences. The company argues that a new owner might start charging for Chromium or fail to maintain it properly, causing widespread disruption across the web browser ecosystem.

The potential sale of Chrome is still far from certain. The remedies trial is ongoing, and a verdict is not expected for some time. Google has indicated it plans to appeal any unfavorable decision, which would undoubtedly prolong the proceedings and could even overturn a ruling that might compel the company to divest Chrome.

The Stakes and Implications

The battle for Chrome represents more than just a corporate acquisition; it's a struggle for the future of internet search, advertising, and AI integration. For Google, losing Chrome would be a significant blow, potentially weakening its dominance in search and advertising. For the contenders, acquiring Chrome would provide an instant platform to challenge Google's hegemony.

The price tag—estimated between tens of billions and up to $50 billion—reflects Chrome's immense strategic value. Any company that succeeds in acquiring Chrome would gain immediate access to billions of users, a powerful platform for promoting their services, and valuable user data that could be leveraged for advertising or AI training.

Looking Forward

As the remedies trial continues and appeals loom on the horizon, the fate of Chrome remains uncertain. What is clear, however, is that multiple tech giants see tremendous value in Google's browser and are positioning themselves to capitalize on any forced divestiture.

For users, the potential change in Chrome's ownership raises questions about privacy, data usage, and the overall browsing experience. Would a new owner maintain Chrome's performance and free access? How would they balance monetization with user experience? These questions remain unanswered as the legal proceedings unfold.

One thing is certain: the race to acquire Chrome has begun, even before it's officially on the market. As one observer noted, Google's rivals are watching closely—"like bidders at an auction, waiting for the hammer to fall". The outcome of this high-stakes battle could reshape the internet landscape for years to come, potentially creating new power players in search, advertising, and AI while diminishing Google's long-standing dominance.

In this tug of war for internet supremacy, Chrome has emerged as the ultimate prize—a browser that could determine who controls the gateway to the digital world for billions of users worldwide.